The American Express® Gold Card and The Platinum Card® from American Express are two of the most sought-after credit cards from American Express – and among travel credit cards, period. But when it comes to comparing the Amex Gold vs Platinum Card, there is a lot to consider.

Both cards may come from the same bank and earn the same American Express Membership Rewards points, but the benefits on each card (and how much they will cost you in annual fees each year) are drastically different. Of course, there's nothing stopping you from holding both cards. But many travelers choose between them – at least to start.

So let's put the Amex Gold and Platinum cards head to head in a number of categories to help you understand how they differ, how they're alike, and help you decide which version is best for you.

Click Here to learn more about the American Express® Gold Card

Click Here to learn more about the Platinum Card® from American Express

Welcome Offers

Both the American Express Gold and Platinum cards currently have welcome offer bonuses that are worth your attention.

But before you dive in, remember: Credit cards are serious business. No matter how big the bonus is, you should never open a new credit card and spend thousands of dollars for the sake of earning points unless you can afford to pay off every dime in full.

Amex Gold Welcome Bonus

Currently, with the American Express® Gold Card, you'll earn 60,000 Amex Membership Rewards points after spending $6,000 in the first six months of card membership.

But you can potentially get an even bigger welcome bonus offer by utilizing CardMatch. Available exclusively from the CardMatch tool from creditcards.com, you may be able to pull up an offer for 75,000 points after spending $6,000 in the first three months. It seems those who have never held an American Express card previously have the best chance of getting targeted.

Even if you aren’t eligible for the 75,000-point offer through CardMatch, you can still get the 75,000-point bonus (plus earn a $250 statement credit on purchases made at restaurants in your first 12 months) by applying for the Gold Card through Resy!

Read More: How to Get a 75K Point Bonus on the Amex Gold Card with CardMatch

Amex Platinum Welcome Bonus

With The Platinum Card® from American Express, you'll earn 80,000 Amex Membership Rewards points after spending $8,000 in the first six months of card membership.

And just as with the Amex Gold Card, you can potentially get a bigger welcome bonus offer by utilizing CardMatch. Using CardMatch, you may be able to pull up an offer for 150,000 points after spending $8,000 in the first three months. Again, it seems those who have never held an American Express card previously have the best chance of getting targeted.

Even if you aren’t eligible for the 150,000-point offer, you can get a 125,000-point bonus (plus earn a whopping 10x points per dollar spent on the first $25,000 spent at restaurants in six months) by applying for the Platinum Card through Resy!

Read More: How to Get a 150K Point Bonus on the Amex Platinum Card with CardMatch

What does your credit score need to be for the Amex Platinum card?

There is no preset score that is needed. However, to increase your chances of approval for the Amex Platinum Card, it is recommended applicants have a credit score of at least 720, two years of clean credit history, and an income of at least $50,000 per year to apply.

Read More: What Credit Score Do You Need for the Amex Platinum Card?

Welcome Offer Winner

The Platinum Card® from American Express

Comparing the welcome bonuses on the Amex Gold vs Platinum is no contest. While both cards are out with big bonuses, what you can currently earn on the Platinum is pretty hard to beat.

Points Earning

While both the Amex Gold and Platinum Cards earn the same points, how fast you can earn points with each card is vastly different.

Earning Points with Amex Gold

First, with the Amex Gold Card, you'll earn 4x Membership Rewards Points per dollar spent at restaurants worldwide. That includes delivery services like DoorDash, Uber Eats, and more. And there's no limit to how many bonus points you can earn on restaurant transactions.

Additionally, you'll earn 4x Membership Rewards Points per dollar spent at U.S. supermarkets on up to $25,000 of spending each calendar year (then 1x). This includes grocery delivery services like Instacart.

Finally, you'll earn 3x Membership Rewards Points per dollar spent on flights booked directly with the airline or through amextravel.com.

You'll earn 1x point per dollar spent on all other eligible purchases.

You'll be hard-pressed to find a card that offers a better return on both your grocery and restaurant bills – two huge sources of spending for many Americans.

Read more: A Full Review of the American Express Gold Card

Earning Points with Amex Platinum

With the Amex Platinum Card, you'll earn 5x Membership Rewards Points per dollar spent on flights booked directly with the airline or through amextravel.com. For this reason (and many more), we think it is the best card for booking airfare.

You'll earn 1x point per dollar spent on all other eligible purchases.

Read more: A Full Review of the Platinum Card from American Express

Points Earning Winner

The American Express Gold Card

The Amex Gold Card always earns 4x points per dollar spent on groceries and at restaurants. Long term, it'll earn you more points and makes more sense for your everyday spending.

You'll earn more with these three categories than you will with just flights on the Amex Platinum Card.

Annual Fee

The annual fee on the American Express Gold card is $250 (see rates & fees). We've crunched the numbers and come to the conclusion it can easily be worth that $250 annual fee.

Meanwhile, the yearly fee on the Platinum Card is much steeper. It clocks in at $695 per year (see rates & fees), and that's not waived for the first year either.

Want to add an authorized user to your card? There is no charge for doing so with the Amex Gold. With the Amex Platinum, you'll $195 total. Those cards will get many of the same benefits as the primary cardholder. But you'll also have the ability to add free companion Platinum card authorized users at no cost. However, those users won't get most of the benefits that $195 authorized users will.

However, these Gold cards won't have the same benefits of the actual Amex Gold card, and won't carry the same benefits as the Platinum Card.

Read more: Is the Amex Platinum Card Worth the $695 Annual Fee?

Annual Fee Winner

The American Express Gold Card

If you are just looking at the upfront out-of-pocket cost to hold either card each year, the Amex Gold wins in a landslide. It's $445 cheaper than the Platinum Card from American Express.

But whether the annual fee is worth it for you is all about whether or not you can maximize all the benefits the card offers. While the annual fee on the Platinum Card is $695, it offers a ton of value which can easily make that worth it.

Statement Credits

Justifying paying a big annual fee on a credit card is all about whether the benefits outweigh the cost. And statement credits on both the Gold and Platinum Cards can go a long way.

Amex Gold Credits

With the Amex Gold, you'll get a $10 credit each and every month to use at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and participating Shake Shack locations. But if you don't use the $10 credit each month, you'll lose it – it won't roll over to the next month. But if use this credit each and every month, that's $120 in statement credits each year.

On top of the $120 dining credit, you'll also get up to a $120 annual credit to use on U.S. Uber rides or Uber Eats food delivery after adding your Amex Gold Card to your Uber app. These credits work much the same as dining credits: You'll get $10 to use each and every month, and you'll lose any unused balance.

Maximize both of these credits and that's up to $240 in value – almost enough to cover the card's entire $250 annual fee.

Amex Platinum Credits

The Amex Platinum Card is also chock full of credits.

Similar to the Gold Card, you'll get up to $200 in Uber Cash to use on Uber rides or Uber Eats food delivery. You'll get $15 to use each and every month – but that jumps to $35 in December. Any remaining balance at the end of the month will be forfeited.

Further, each year you hold the Platinum Card, you also receive up to a $200 travel credit to use with one selected airline. The credit is intended to be used for things like checked bags, change or cancelation fees, seat assignments, lounge access, and more. Critically, buying airfare outright generally won’t work to get your credit, nor will cabin upgrades, buying miles, and several other similar purchases. But there are some creative ways to put these credits to use, so be sure to read our post on the best ways to maximize Amex airline credits!

This credit resets each calendar year, so each January you will get $200 to use. If you have any remaining credit from the previous year, it won’t carry over.

Once every four years, you'll also get up to a $100 credit to cover the cost of either Global Entry or TSA PreCheck. Membership in either program is good for five years. And if you hope to do any international travel, Global Entry should be your choice as it includes TSA PreCheck.

You'll also receive an annual credit of up to $189 to cover the cost of a CLEAR® Plus membership, and up to a $240 annual digital entertainment credit. You'll get up to $20 in statement credits each month when you pay for eligible purchases at Peacock, The Wall Street Journal, The New York Times, The Disney Bundle, ESPN+, and Hulu.

You'll receive an up to $200 annual hotel credit.

Each year, you will also get $100 in statement credits to spend at Saks Fifth Avenue: $50 from January through June, and another $50 to spend from July through December. Again, this is a use-it-or-lose-it benefit.

Finally, you'll get $155 towards a Walmart+ membership each year. This is dolled out in the amount of $12.95 each month.

Read our post on How to use the $189 CLEAR® Plus Credit for Two!

Statement Credits Winner

The Platinum Card from American Express

Add up all the credits on the Platinum Card and you can get over $900 back in your first year, though the final sum depends on when you opened your card, and your ability to actually use some of these benefits. But no matter how you slice it, you can easily come out ahead on the otherwise steep $695 annual fee.

Lounge Access

If you're primarily looking to get into airport lounges, pay close attention. Comparing the Amex Gold vs Platinum card is no contest at all.

That's because the American Express Gold Card will not get you access to any airport lounges. The Amex Platinum Card, meanwhile, is arguably the best credit card to get into airport lounges, period. No other credit card will open more airport lounge doors.

To start with, you'll have access to American Express's incredible Centurion Lounges – plus you can bring up to two guests in with you completely free – at least until early February 2023.

These lounges are scattered throughout the U.S. at more than a dozen airports and counting – plus in Hong Kong (HKG) and in London-Heathrow (LHR). Centurion Lounges typically put many other domestic airline lounges to shame, with great free food and drink. Make sure to read our Centurion Lounge guide to learn more.

But you'll also get a Priority Pass Select membership that will allow you and up to two guests to access over 1,300 airport lounges around the globe. Think free drinks, food, etc. Read our Ultimate Guide to Priority Pass.

Next, you will get access to the Delta Sky Club – but only if you are flying Delta that day. And while you won't get any free guests, you can bring guests with you for $39 each.

Finally, you will get access to several smaller lounge networks including Plaza Premium, Air Space, and one of our favorites, Escape Lounges – The Centurion Studio Partner. These lounges are at a growing list of airports around the country, including our favorite lounge at our home airport of Minneapolis/St. Paul (MSP).

Lounge Access Winner

The Platinum Card from American Express

This category isn't particularly close. The Amex Gold Card doesn't offer any sort of lounge access while the Amex Platinum Card is the best option out there for accessing airport lounges and making your entire experience at the airport better.

Elite Status Perks

If you're on the hunt for hotel or car rental status, the Platinum Card really starts to pull away.

Just as with lounge access, the American Express Gold Card will not get you any sort of elite status perks or benefits. On the other hand, just for holding the American Express Platinum Card, you will receive complimentary Marriott Bonvoy and Hilton Honors Gold status.

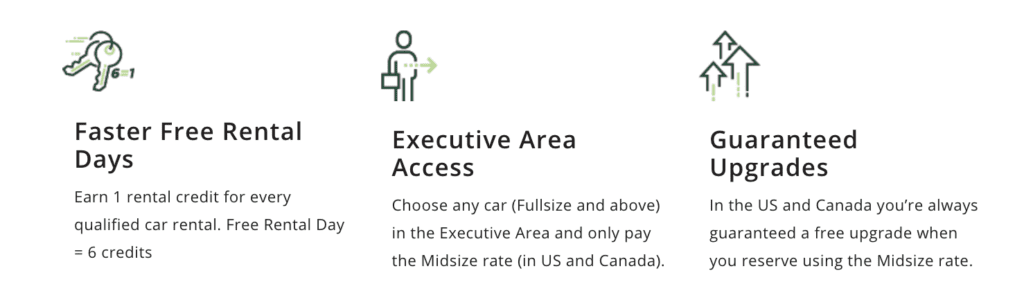

But you’ll also get elite status in a handful of rental car programs, including National Emerald Club Executive status. That gets you a handful of benefits the next time you need to rent a car, but one stands out: Access to the Executive Area and the ability to completely skip the rental car counter upon your arrival.

Skip the lines at the counter and mountains of paperwork. You can simply walk off the plane, head to the car rental area, select your car, and go. It will minimize your contact with others and allow you to keep a safe social distance. And it’s often much faster.

As long as you book at least the midsized car rate, you’ll have access to any vehicle in the Executive area for no additional charge! Emerald Club Executive members are also guaranteed a free upgrade in the U.S. and Canada – assuming you book at least a midsized car.

Read more: National Executive Status: Upgrade Your Car with the Right Credit Card

Elite Status Perks Winner

The Platinum Card from American Express

Again, this category isn't particularly close. The Amex Gold Card doesn't offer any sort of elite status perks while the Platinum Card offers complimentary Marriott and Hilton Gold status, and National Executive Elite status just for holding the card.

Redeeming Points

Comparing the Amex Gold vs Platinum Card, there is no advantage to holding one card versus another.

No matter whether you redeem your points directly through the Amex travel portal or transfer them to nearly two dozen airline or hotel transfer partners, you've got identical options with these two cards. Booking direct with amextravel.com, each point is worth 1 cent apiece. That's a departure from Chase, which gives cardholders of the Chase Sapphire Reserve® a bigger bonus than the Chase Sapphire Preferred® Card when booking travel with points.

Meanwhile, here's a full list of American Express Membership Rewards transfer partners.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Hawaiian | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

Make sure to read our post on the best ways to redeem Membership Rewards Points.

Redeeming Points Winner

This category is a tie. When it comes time to use your points, neither card comes out ahead.

Bottom Line

Here's a recap of some of the key differences when comparing Amex Gold vs Platinum:

- An Amex Gold card costs $250 annually, and an Amex Platinum card costs $695 each year.

- Only the American Express Platinum credit card can get you into the Centurion Lounges, Delta Sky Clubs, and a Priority Pass Lounge Membership.

- Add up all the credits on the Platinum Card and you can get over $900 back in your first year. This of course depends on your ability to actually use these credits.

By the numbers, the Platinum Card takes four categories while the Gold Card takes two, and one category ends in a tie.

But everyone may – and should – weigh each of these categories differently. For some, earning 4x at restaurants and supermarkets may give the Gold Card the edge, especially considering its lower price tag. For others, lounge access and hotel status can make the Platinum Card the clear favorite despite its high cost.

Select the card that makes the most sense for you and how you will use it. And keep in mind, that many people carry both the Amex Gold and Platinum Cards as they both provide value in different ways. Carrying both cards can be an upfront drain on the pocketbook by paying $945 each year in annual fees, but it can easily be worth it if you can maximize all the benefits.